2020 has been a hugely turbulent year regarding Brits and their spending habits. We have seen record breaking online transactions, none larger than Amazon, who saw a 37% increase in revenue during the pandemic. Whilst other stores have seriously struggled, with 51 UK retailers going bankrupt in 2020 alone.

Black Friday however, is just around the corner and with 2019 seeing 194 million visits being made to UK online retail sites alone, amounting to Brits spending an eye watering £8.57 Billion. The Black Friday tradition has successfully made its migration from our US neighbours. What, therefore, will happen this year when the turbulence of 2020 meets the busiest shopping day of the year, where spending is already expected to be 18% more than 2019? How will this affect consumer intent and brand performance?

Using data from the past three years and identifying changes in purchase intent between the week prior and the week during Black Friday we were able to see who actually gets a boost in purchase consideration during Black Friday.

Averaging these changes in purchase intent across 200+ brands over 5 sectors we can see who usually gets the biggest increase in sales.

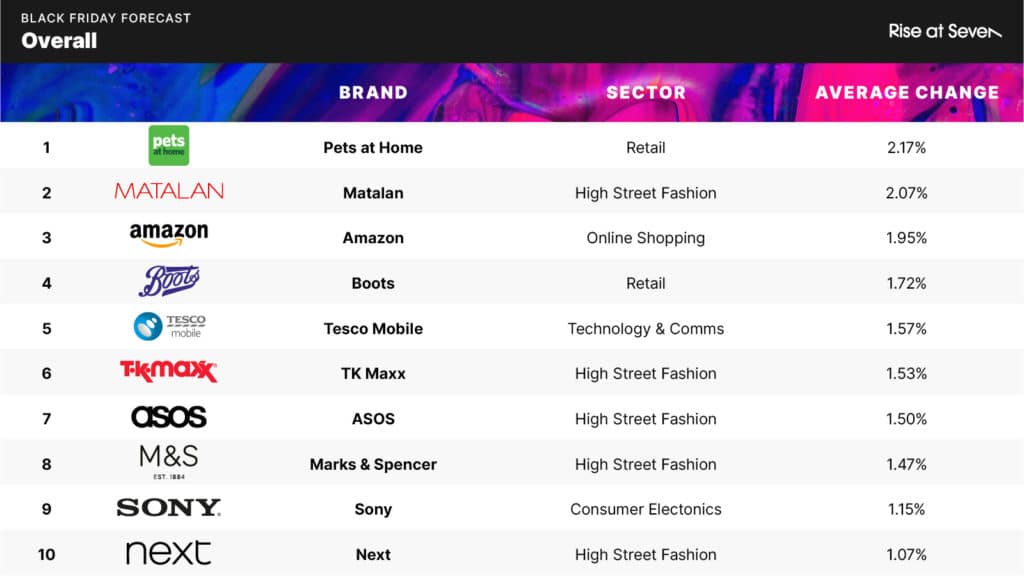

Overall Top 10

Out of all the brands, these are the ones that will see the biggest increase in purchase intent during Black Friday:

This Top 10 does feature some surprises including Pets at Home being in top position! This projected success however, could be down to the fact that pets (and their accompanying products) are seasonal with the regular campaign from The Dogs Trust supporting this - ‘A dog is for life not just for Christmas’.

The rankings are dominated by High Street Fashion (Matalan, TK Maxx, ASOS, M&S and Next), which occupy 50% of the positions. This is unsurprising when considering that fashion is where 29% of consumers expect to spend the most money on Black Friday.

It is no surprise that Amazon is on the list, but it does point towards it’s retail dominance when you consider that Prime Day and Cyber Monday occur on either side of Black Friday. Yet they still see a significant increase in purchase intent.

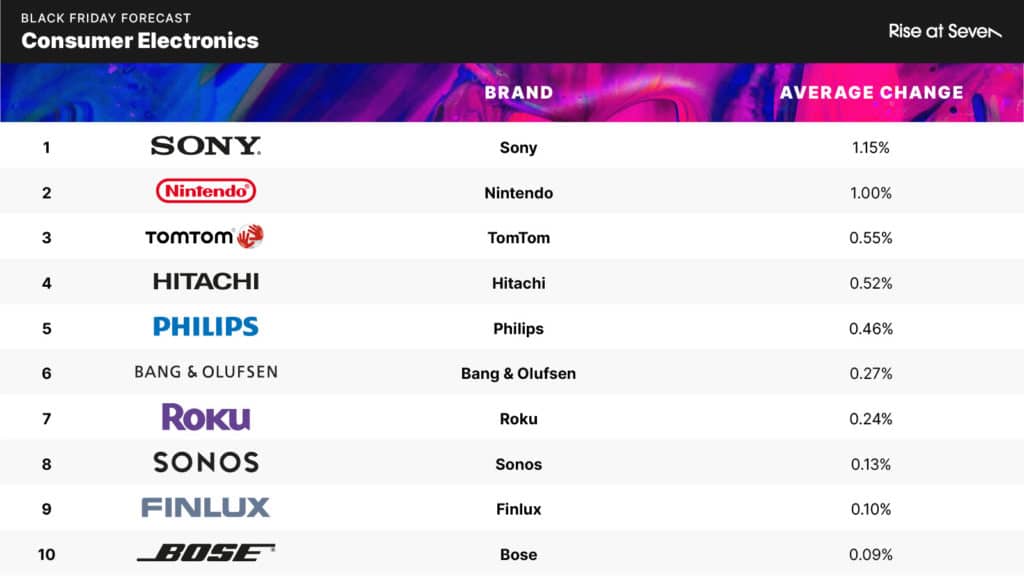

Technology and electricals are where 53% of consumers expect to spend the most money on Black Friday. Sony should therefore see a significant boost in purchase intent, especially with the release of new products including the PS5 (which is the most in demand games console in the world).

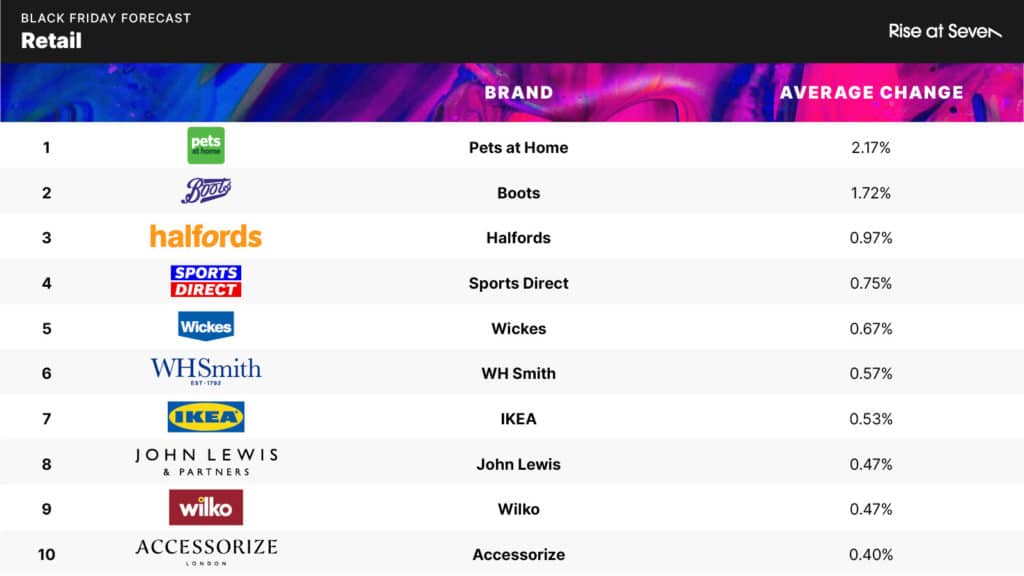

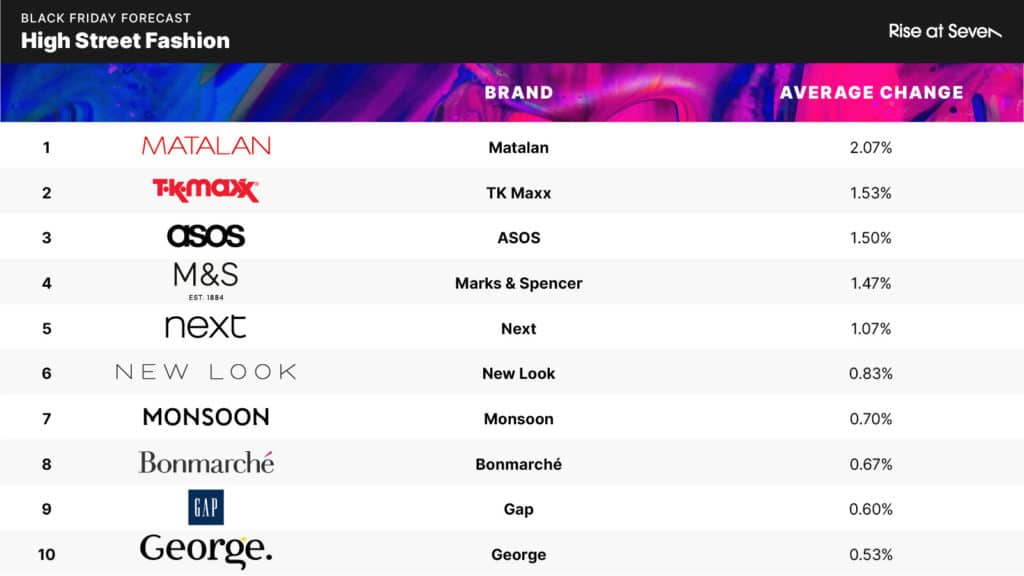

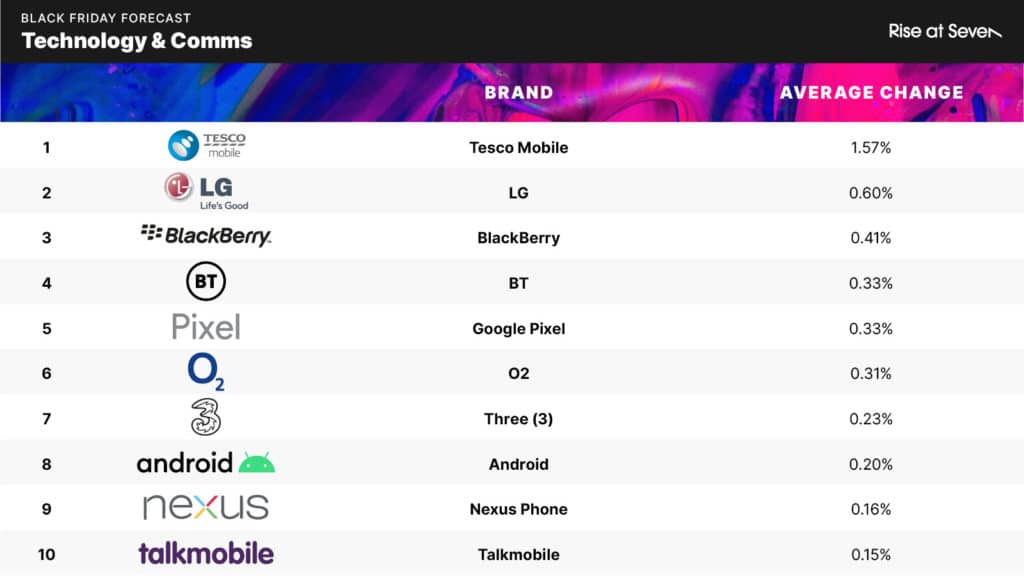

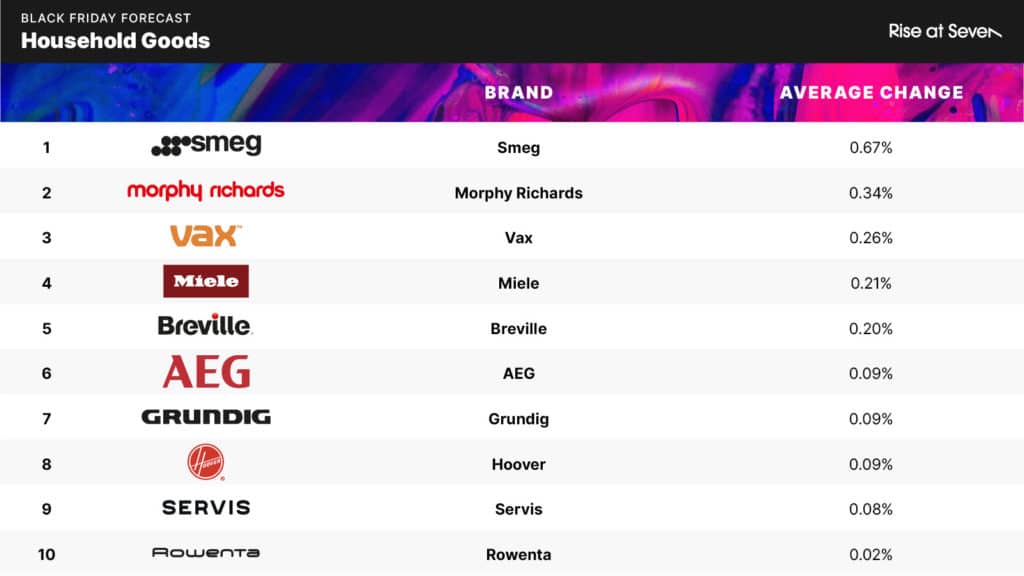

Sectors

Below are the top 10 brands, over 5 sectors, predicted to get the largest boost in purchase intent on Black Friday.

These results are based on the past three years, and they are just a prediction. It is almost impossible to say what impact COVID will have on the results. However, in December we will look back on these predictions to compare and see how much of an impact the pandemic has had on Black Fridays purchase intent.

References